Every week, without fail, the headlines scream:

“Gen Z will never own a home.”

“The dream is over.”

“Housing crisis deepens.”

“Cost of living has sky rocketed.”

Turn on talkback radio, scan your feed, or listen to a panel show – and it is the same fear-driven rhetoric on repeat.

But here is the truth: property prices aren’t the problem.

A lack of preparation is.

And the real crisis? It’s not in housing – it is in how we’re raising and educating the next generation.

Let’s talk real numbers.

In 2000, we bought a house in Mulgrave for $160,000. Today, that same home is worth $1.2 million.

Back in 1981, our family home in Adelaide cost $80,000. It is now worth over $1.3 million.

Sounds insane, right? But here’s the context:

• In 1980, the average wage in Australia was around $14,500.

• In 2000, it rose to $34,000.

• By 2019, it was $89,000.

In comparison:

• A loaf of bread was 54 cents in 1980. Now? $3.50.

• Electricity was 5.4 cents/kWh in 1980. Now? 19 cents/kWh.

• Fuel was 3 cents a litre in 1980. Now? $1.79 per litre.

Yes, things are more expensive, but so has income risen exponentially.

So, stop saying young people can’t buy. The question is: have we equipped them with the right tools?

The Root Cause: We Are Failing Our Kids

Our children do not need handouts. They need hand-ups.

They need financial education. They need grit. They need to know how to navigate life with clarity and confidence.

Not finish their trade school and jump to a $100K salary and the first thing they do is go and buy a brand new Hilux!

Our two older kids, 23 and 24 – both own homes.

One of them, Saffal, owns three. No inheritance. No silver spoon. Just solid advice, clever planning, and zero victim mentality.

Why?

Because they were raised with:

• Financial literacy

• Self-responsibility

• A relentless work ethic

• A belief that they could, and would, succeed

They have been taught how to use the system, not complain about it.

Meanwhile, the rest of society is bubble-wrapping kids into helplessness.

We tell them “the world’s too expensive” and “life’s unfair.” We mollycoddle them. We fill their ears with fear and their futures with doubt.

Dad’s favourite line is “Fair? What is fair?”

Politicians & Media: Stop the Fear Mongering

We’ve got land. We’ve got opportunity. But we’ve got short-sighted leadership.

Media thrives on crisis because panic drives ratings.

Politicians thrive on reaction because outrage gets votes.

But where is the vision? Where is the policy with backbone and imagination?

We need:

• Multigenerational lending options to promote family wealth and resilience

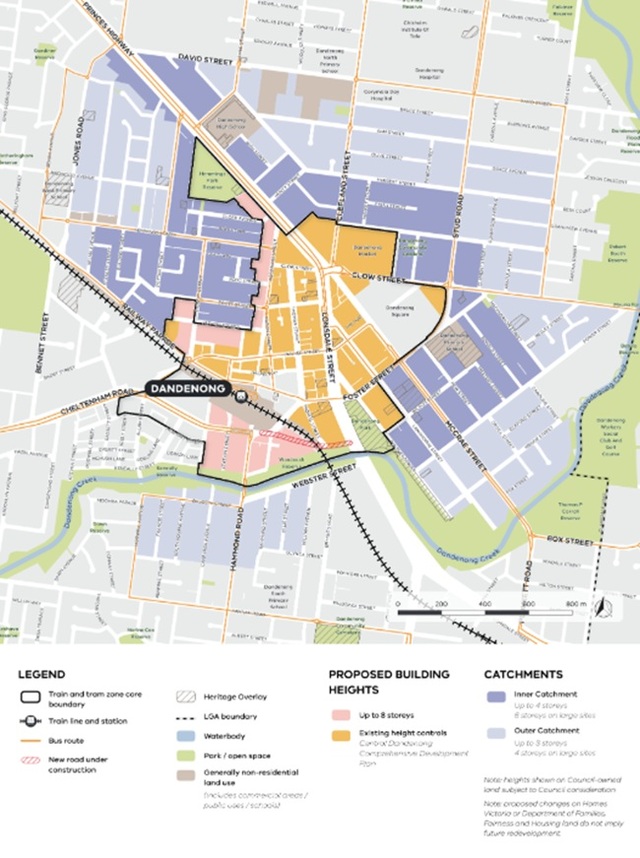

• Zoning that encourages smart housing, not urban sprawl

• Schools teaching money skills, not just trigonometry

• Mental health support that prioritises dignity over dependency

• Leaders who stop reacting and start creating

The Solution: Empowerment Over Pity

We have spent 30 years working in real estate and financial literacy. We have delivered workshops that wake young people up and show them what is possible. And funny thing is, it works!

Give kids:

– A breakdown of how mortgages work, assets, liabilities and sustainability

– The truth about compound interest and living within your means

– Access to property grants and smart investment tools

– A mindset that embraces action, not blame

And they will stop asking “Why can’t I?” and start saying “Watch me.”

We don’t need more headlines. We need more hope.

Hope with substance. With guidance. With real tools.

Parents: empower your kids.

Schools: teach them life, not just exams.

Banks: innovate, don’t be greedy.

Politicians: lead. For real.

Let’s reclaim the Australian dream – not with nostalgia, but with knowledge.

Let’s raise a generation who does not just survive – but thrives.