As tax season approaches, Norton Security warns Australians to be cautious as various tax specific scams being to emerge with an influx of cyber threats.

Tax time can bring stress and confusion for both individuals and businesses as they prepare to file their returns with the ATO.

Unfortunately, this breeds the perfect environment for cybercriminals who seek to prey on these vulnerable emotions, obtain sensitive information and cause both financial and personal harm to unsuspecting victims.

Mark Gorrie, APAC managing director at Norton said, “There are certain times each year that pique cybercriminals’ interest and tax time is one of them. With the amount of personal and financial information that is being stored and shared at this time, coupled with the stress that comes with filing tax returns, it is the perfect storm for scammers to target Australians.”

In 2022, Australians lost over $3 billion to scammers according to the ACCC, and the numbers are only expected to continue to increase unless people remain more vigilant and stay one step ahead of savvy fraudsters.

Mr Gorrie said practicing online security should never be sacrificed in exchange for convenience during these rough times.

“In the wake of greater sophistication and a rise in AI that is aiding cybercriminals in evolving and developing their devious tactics, it is more important than ever that Australians are continuing to educate themselves on the warning signs.”

These are the three prevalent tax scams for Australians to look out for and ways to avoid them.

1. Tax-related identity theft.

This scam occurs when cybercriminals access a victim’s account, impersonate them, and fraudulently lodge refunds from the ATO using your stolen personal information, including your tax file number (TFN). This can be dangerous, as in this instance, the cybercriminal who filed a return with your information may still have your data – leaving you vulnerable to other identity-related crimes.

How to avoid this scam:

• Keep your tax file number safe. Shred any documents that contain personal information before you throw them away, and ensure that your online accounts containing sensitive information, like myGov, are protected with strong passwords and two factor authentication.

• If you suspect your TFN and identity has been compromised, immediately report the incident to the Australian Taxation Office (ATO).

• Consider using a robust security software, like Norton 360. This will help protect your personal devices and information, and act as a first line of defense against attempts by criminals to steal or compromise your personal

information.

2. Dodgy tax preparers offering to complete your tax refund.

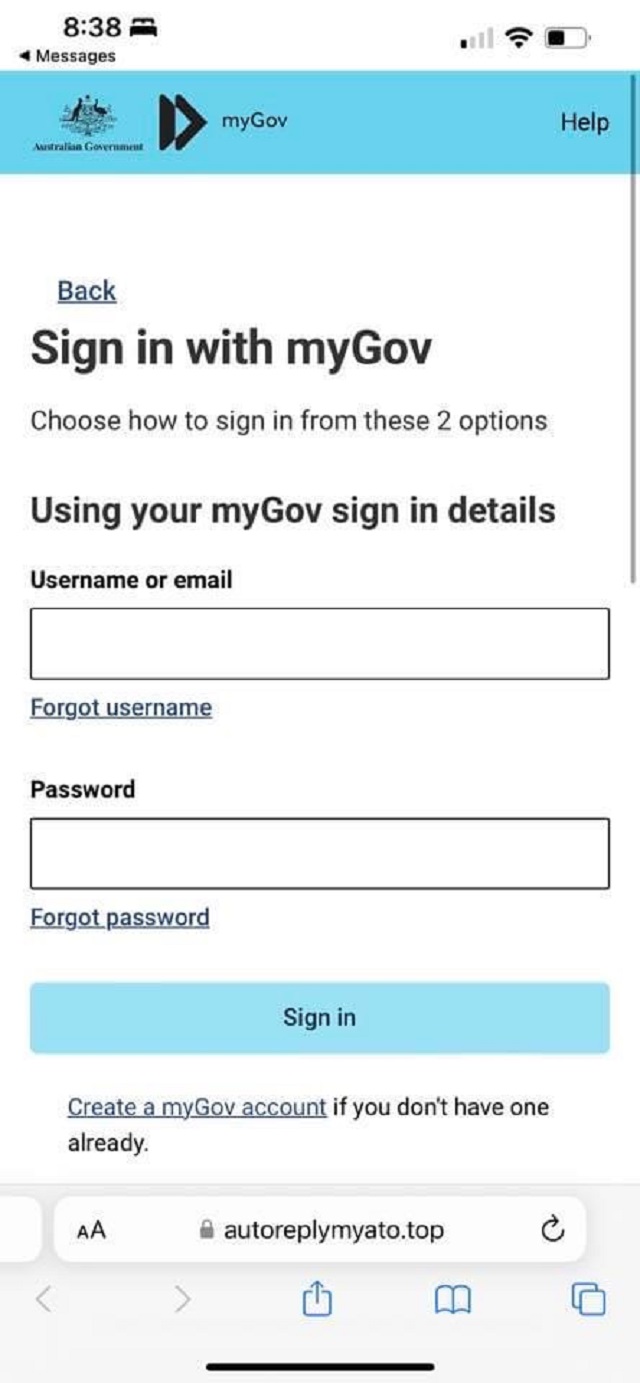

Scammers capitalizing on the desire for maximum tax refunds will promise substantial returns and a speedier process, which can appear to be an enticing offer in an otherwise confusing and stressful time. The fraudsters will ask for access to the myGov accounts of their victims and lodge tax returns through the ATO’s myTax web portal or take personal details and payment before disappearing.

How to avoid this scam:

• If someone approaches you claiming to be a tax preparer, you can check that they are registered on the Tax Practitioners Board (TPB) by visiting their website to verify the legitimacy of their claims. (https://www.tpb.gov.au/registrations_search)

• Never share your myGov password with anyone. Sharing your information (such as your myGov password) with an unregistered practitioner puts your personal and financial affairs at risk.

• Enable two factor authentication on myGov. You can use either the myGov Code Generator app or receive a code by SMS when logging in. This will further protect you from unauthorised access to your myGov account.

3. Be cautious of Australian Taxation Office (ATO) impersonation scams. Cybercriminals will pose as ATO representatives to convince victims to provide their bank details, Tax File Number, or other personal information via SMS, email, or social media accounts.

Additionally, in January this year, the ATO issued a warning about scammers posing as ATO workers on Twitter, Facebook, TikTok and other popular social media platforms. These phony accounts prey on social media users who have made public comments addressing the ATO with a question or complaint. The scammer sends their victim a direct message, offering to assist in resolving the issue. After gaining trust, the scammer attempts to obtain personal information.

How to avoid this scam:

● Look out for tell-tale signs of a scam. The ATO won’t use urgent threats, such as arrest, payment, or suspension of your TFN. If contacted via social media by a newly created unverified account with a small follower account,

● If you receive a suspected scam email or SMS, do not click on any links, provide any payments, account log in information, or other personal information.

● Occasionally, the ATO will contact you by phone, email, SMS, and post. If you are not sure about the validity of any communication, the best thing to do is to call the ATO directly. You can obtain a phone number from their official website,

or a previous letter you have received, and validate the request.